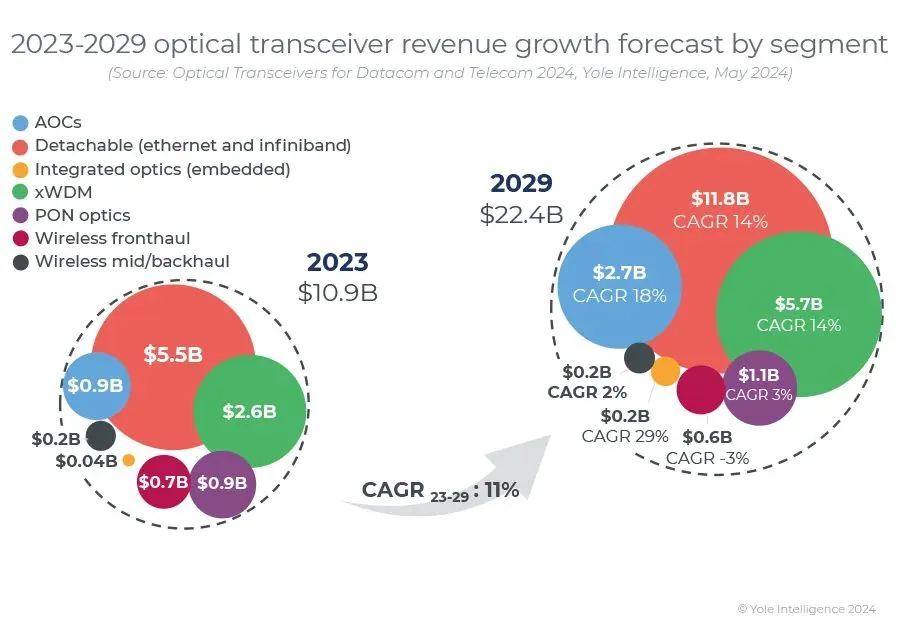

Recently, market research institution YOLE Group pointed out in its latest market report that in the datacom segment in 2024, the AI-driven optical module market will witness a year-on-year growth of 45%.

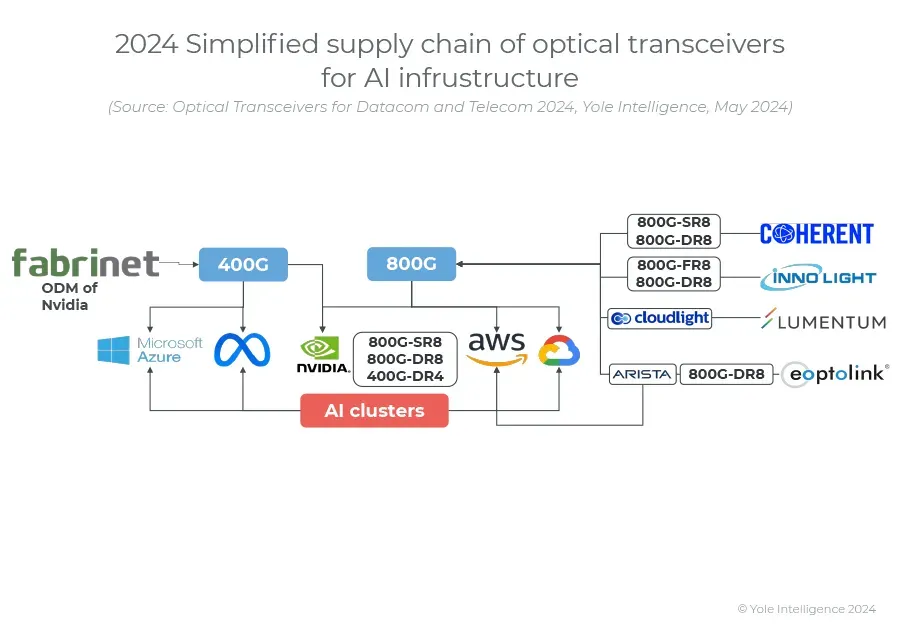

At the beginning of 2023, the outlook for the optical module market was dim due to reduced demand from data centers and a slowdown in capital expenditures. However, starting from March 2023, driven by hyperscale customers such as Google, Amazon, and Nvidia, the demand for 800G optical modules has soared, driving a significant increase in orders and shipments.

Later in 2023, Microsoft and Meta also increased their demand for 400G optical modules, reflecting the expanding AI-driven market. Suppliers are preparing for a significant increase in 800G and 400G revenues by increasing production capacity and ensuring the supply chain. The overall revenue of the optical module market slightly decreased from $11 billion in 2022 to $10.9 billion in 2023, but it is expected to reach $22.4 billion by 2029 due to the high demand for high-speed optical modules above 400G from cloud computing vendors and telecom operators. The revenue growth rate is expected to reach 27% in 2024.

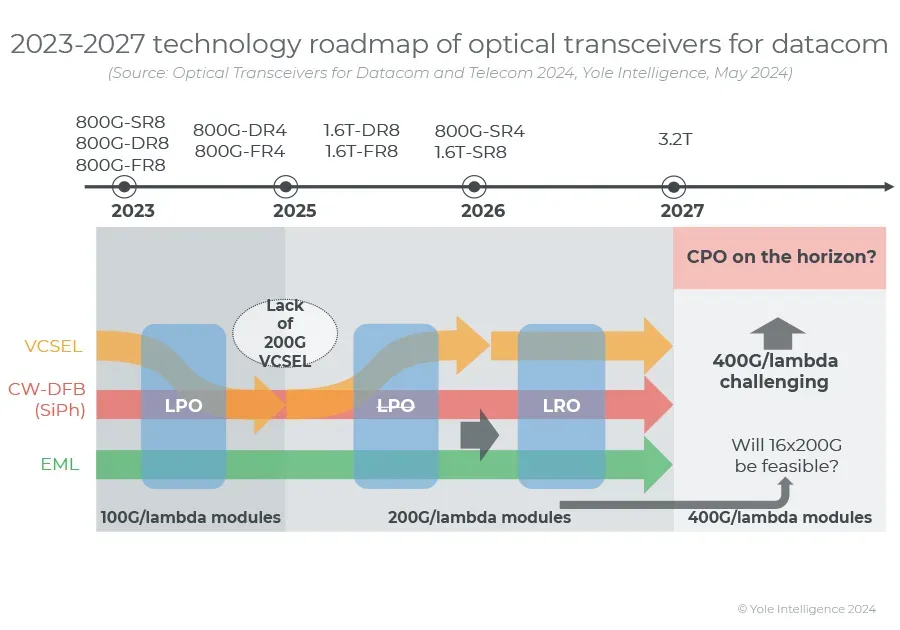

The demand for 400G and 800G datacom optical modules, especially from Nvidia, Google, and Amazon, has had a significant impact on revenue. Coherent and Innolight are leading in the multimode and single-mode application fields respectively. The industry is increasing the single-channel rate of 800G links from 100Gb/s to 200Gb/s to reduce power consumption and costs. EML and CW-DFB devices are ready for 200G/lane applications, while 200G/lambda VCSEL is expected to enter mass production in 2026.

Integrated photonics technology provides low-cost and scalable optical solutions, especially in the field of communications. As optical links develop towards higher speeds and shorter distances, silicon photonics technology (SiPh) stands out. Utilizing CMOS technology, SiPh has the advantages of high performance, low cost, high yield, and mass production.

SiPh can carry various photonic components, but it is limited in terms of laser sources compared to III-V materials such as InP and GaAs. The transitional solution for CPO is linear drive pluggable optical devices (LPO), which has no DSP or CDR and can reduce power consumption and latency. This is crucial for applications such as switch-to-switch, switch-to-server, and GPU-to-GPU connections in ML and HPC. LPO will be available for multimode (VCSEL) and single-mode applications (EML, SiPh), but works best when used in conjunction with linear modulators such as TFLN, BTO, and Organics combined with SiPh.

The technical ecosystem of LPO is ready, and 100G SerDes has been integrated into the latest network switch chips. The OFC 2024 conference focused on discussing linear receive optical devices (LRO) suitable for 1.6T (8x200G) applications, which can improve performance and robustness.