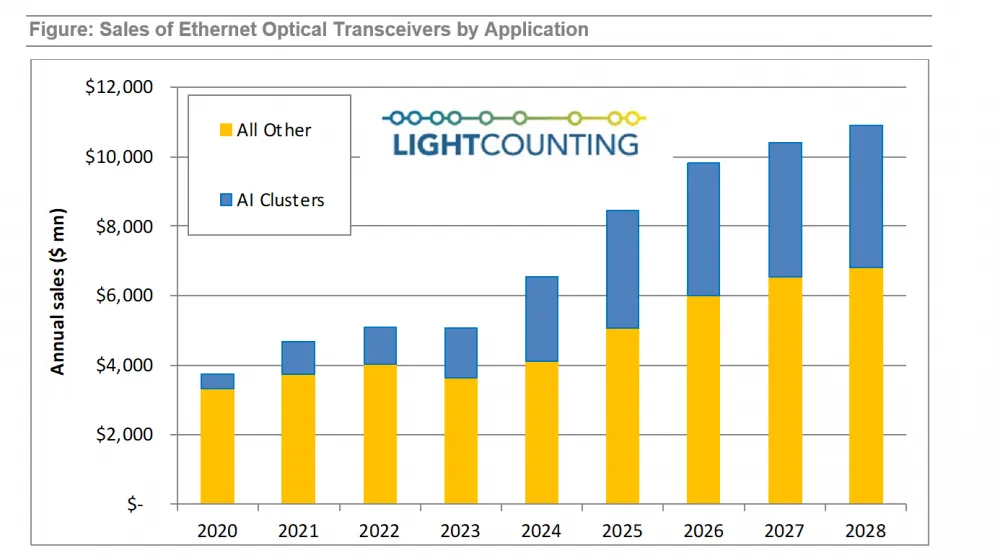

The “hegemony” competition in artificial intelligence is unfolding in full swing. Since July 2023, the market research institution LightCounting has revised the sales forecast for Ethernet optical modules upward every three months. The latest report shows that Ethernet optical modules used in AI clusters will more than double in 2024 and continue until 2025 – 2026.

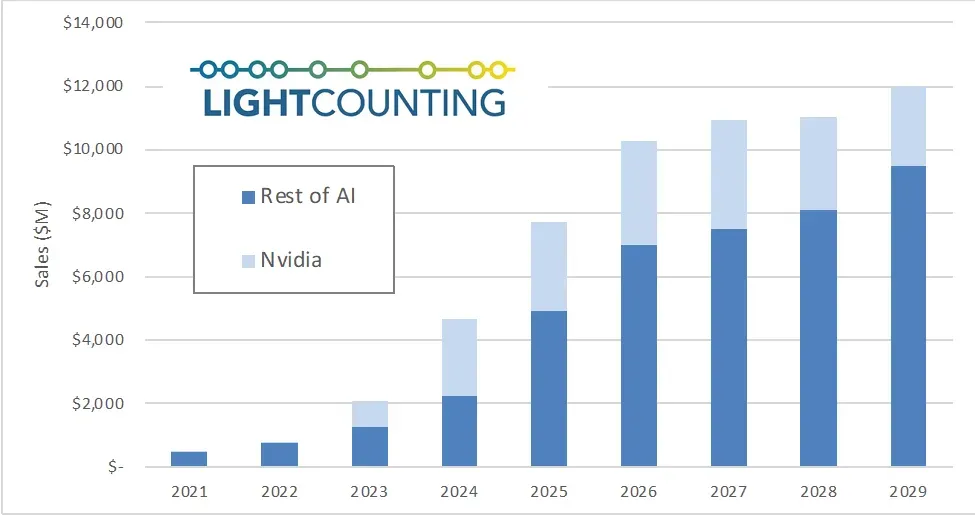

However, LightCounting points out that this growth will not continue indefinitely. A “soft landing” is expected to occur in 2027, and the market may decline at some point. The timing of such a decline is difficult to predict, and it is typically seen on average every three years. The strong demand has already posed challenges to the entire supply chain, and the situation could get worse. Customers may start to place additional orders to cope with the ongoing shortage, thereby exacerbating the problem. Once the shortage eases, demand may decline, resulting in excessive inventory throughout the supply chain. This is exactly what happened at the end of 2019 and the end of 2022. The following figure also shows Nvidia’s contribution to the optical module market. Many of Nvidia’s customers, including Microsoft, have purchased Nvidia’s entire system, including optical modules. This may not be the most economical approach, but it is an “arms race”. However, LightCounting believes that more companies are expected to start bypassing Nvidia to purchase optical modules in the future.

Between May and June 2023, Google and Nvidia became the first manufacturers to significantly increase their purchases of optical modules. Now, all leading cloud computing companies have joined this competition. Currently, the demand for 4x100G and 8x100G optical modules exceeds the supply by 100%, and many customers have to wait until 2025 for delivery. LightCounting has raised its forecast for 4x100G optical modules by $500 million in 2025 and by $1 billion in 2026. The sales of these products are expected to peak at over $4 billion in 2026. At the same time, the forecast for 8x100G optical modules in 2025 has increased by $2 billion, and the sales of these optical modules are expected to exceed $7 billion in 2026. In addition, the first batch of 4x200G and 8x200G optical modules will be shipped at the end of 2024. It is worth noting that LightCounting has also added 3.2T optical modules to the forecast model. By 2029, the total sales of 1.6T and 3.2T optical modules, LPO, and CPO will reach nearly $10 billion, accounting for the majority of the sales of optical module products for artificial intelligence clusters.