Supply chain shortage and IC chip price increase, optical module prices stop falling

LightCounting released the latest report on the high-speed Ethernet optical module market. It is estimated that this market segment will set a new record of US$4.6 billion in 2021, an increase of 24% compared to the US$3.7 billion in 2020. It is far exceeding the 10% growth predicted 6 months ago. Why is this?

LightCounting said that back to the beginning of 2020, optical module suppliers quickly recovered from the impact of the new crown epidemic. The demand for all products from 1GbE to 400GbE exceeded expectations throughout the year, and even the sales of 1GbE optical modules increased, not to mention Talk about 10G and 40G products.

Although the demand for traditional low-speed products began to decline at the end of 2020, it rebounded again in the first half of 2021. LightCounting believes that this is unexpected. The most likely scenario is that the new round (and possibly the last wave) of demand for traditional products comes from the upgrade of enterprises and telecommunication networks, and these upgrades are mainly postponed due to the epidemic. NS.

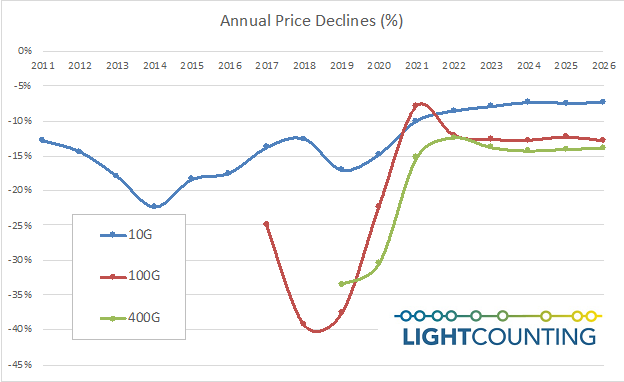

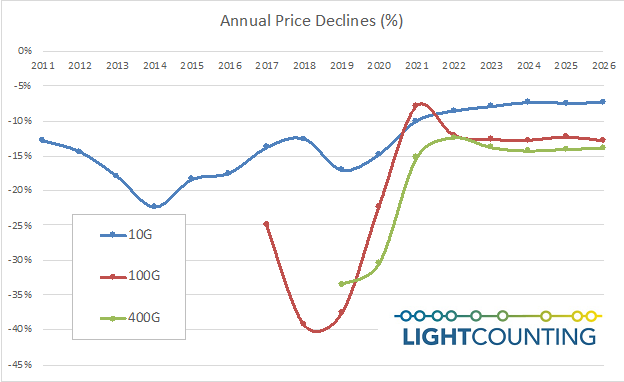

Another very positive but unexpected development is more stable pricing. Can you believe it? We may no longer see a 40%-50% annual price drop in 2018-2019.

As shown in the figure above, in the past ten years, the price of 10GbE optical modules has fallen by an average of 15% per year. For new products, a 40%-50% annual price drop is reasonable, but 100GbE is not new in 2018-2019. The demand for 100GbE has always been unstable, competition is too fierce, and new suppliers continue to enter the market. Is it all over now?

LightCounting said that the collected sales data for the first half of 2021 show that the market is in the slowest annual price decline period on record: the price of 100GbE has fallen by less than 10%. And not just 100GbE, the price of most products tracked by LightCounting will only drop by about 10% in 2021, but the shortage of the entire supply chain and higher prices of IC chips explain this anomaly.

LightCounting said that the market is expected to recover to an average price drop of 12%-15% in 2022-2026. This is in line with the historical average, excluding the crazy years of 2018-2019.